The Ultimate Guide to Getting a Travel Insurance Quotation: Ensuring a Worry-Free Journey

Traveling is an enriching experience, opening doors to new cultures, breathtaking landscapes, and unforgettable adventures. However, unforeseen circumstances can disrupt even the most meticulously planned trips. That's where travel insurance comes in, acting as a safety net to protect you from unexpected medical expenses, trip cancellations, lost luggage, and other travel-related mishaps. Obtaining a travel insurance quotation is the first step toward securing this vital protection, and understanding the process is crucial for making informed decisions.

Okay, here's a comprehensive and engaging blog post on getting a travel insurance quote, designed to be informative, unique, and SEO-friendly.

This guide dives deep into the world of travel insurance quotations, providing you with everything you need to know to find the best coverage at the right price. We'll explore the factors that influence your quote, how to compare different policies, and pro tips to save money without compromising on essential protection.

Why is a Travel Insurance Quotation Important?

A travel insurance quotation is more than just a price tag; it's a comprehensive overview of the coverage you'll receive and the financial protection it provides. It allows you to:

- Understand the costs involved: Knowing the premium beforehand allows you to budget effectively for your trip.

- Compare different policies: A quote provides a clear breakdown of what's covered, enabling you to compare policies from various providers.

- Assess your needs: Reviewing the coverage options in a quote helps you identify the specific protection you require for your trip.

- Make informed decisions: Armed with a clear understanding of the costs and coverage, you can choose the policy that best suits your individual circumstances.

Factors That Influence Your Travel Insurance Quotation

Several factors play a role in determining the cost of your travel insurance. Understanding these factors can help you anticipate your quote and potentially lower your premium.

Destination:

- The destination is one of the most significant factors affecting your travel insurance quote. High-risk destinations, such as countries with unstable political situations or regions prone to natural disasters, will typically result in higher premiums.

- Countries with expensive healthcare systems, like the United States, Canada, and some parts of Europe, also tend to increase the cost of travel insurance due to the potential for high medical bills.

- Conversely, traveling to countries with lower healthcare costs and stable environments may result in more affordable premiums.

-

Trip Duration:

- The length of your trip directly impacts the cost of your travel insurance. Longer trips pose a greater risk of unforeseen events, such as illness, injury, or trip interruptions.

- Insurance providers factor in the increased exposure to risk when calculating premiums for extended travel periods.

- If you're planning a multi-month backpacking adventure, expect to pay more than someone taking a week-long vacation.

-

Age:

- Age is a significant factor in determining travel insurance costs. Older travelers generally face higher premiums due to an increased risk of medical issues.

- As we age, the likelihood of pre-existing conditions and the potential for health complications increases, making older travelers a higher risk for insurance companies.

- Younger travelers, on the other hand, typically enjoy lower premiums as they are statistically less likely to require medical attention.

-

Pre-Existing Medical Conditions:

- Pre-existing medical conditions are a crucial consideration when obtaining a travel insurance quote. These are any health conditions you have before purchasing the policy.

- Insurance providers need to assess the risk associated with covering these conditions, which can lead to higher premiums or even exclusions from coverage.

- It's essential to declare all pre-existing conditions when applying for travel insurance, as failing to do so can invalidate your policy.

-

Coverage Amount:

- The amount of coverage you choose for medical expenses, trip cancellation, and other benefits directly impacts your premium. Higher coverage limits provide greater financial protection but also come with a higher price tag.

- Consider your risk tolerance and the potential costs you could face in the event of an emergency when selecting your coverage amounts.

- Opting for lower coverage limits may save you money on your premium, but it could leave you vulnerable to significant financial losses if something goes wrong.

-

Activities Planned:

- The activities you plan to participate in during your trip can affect your travel insurance quote. High-risk activities, such as skiing, scuba diving, rock climbing, and other adventure sports, typically require additional coverage and will increase your premium.

- Insurance providers assess the potential for injury associated with these activities and adjust their rates accordingly.

- If you plan to engage in any adventurous pursuits, be sure to declare them when obtaining your quote to ensure you have adequate coverage.

Where to Get a Travel Insurance Quotation

There are several avenues for obtaining a travel insurance quotation, each with its own advantages and disadvantages.

- Directly from Insurance Providers: Contacting insurance companies directly allows you to speak with representatives who can answer your questions and provide personalized quotes. You can find many insurance providers online.

- Online Comparison Websites: These websites aggregate quotes from multiple providers, allowing you to compare prices and coverage options side-by-side. This is a convenient way to get a quick overview of the market. Pro tip from us: Always double-check the details on the insurer's official website before making a final decision.

- Travel Agents: Travel agents can often provide travel insurance quotes as part of their service when booking your trip. They may have access to exclusive deals or packages.

- Credit Card Companies: Some credit cards offer travel insurance as a perk. Check the terms and conditions to see what coverage is included and whether it meets your needs.

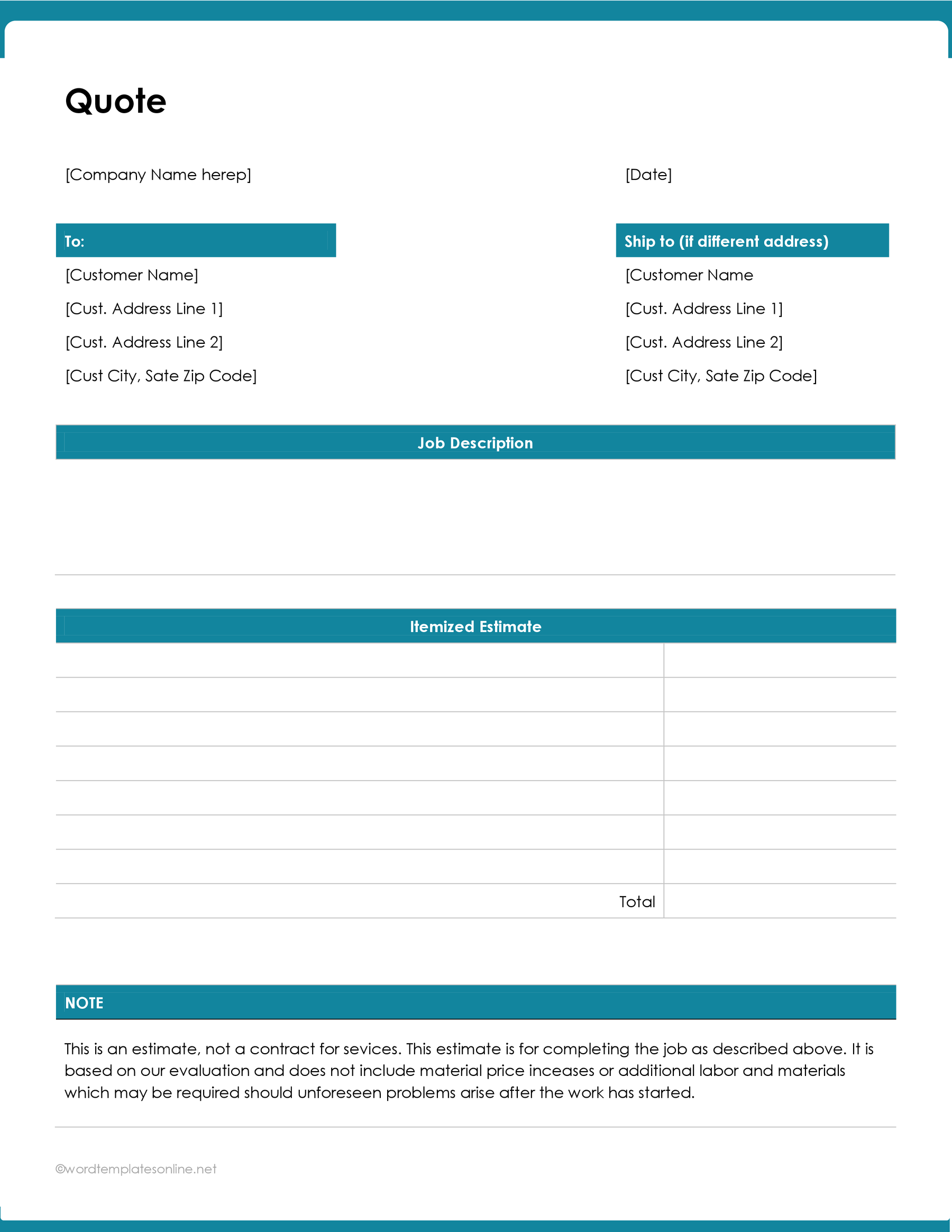

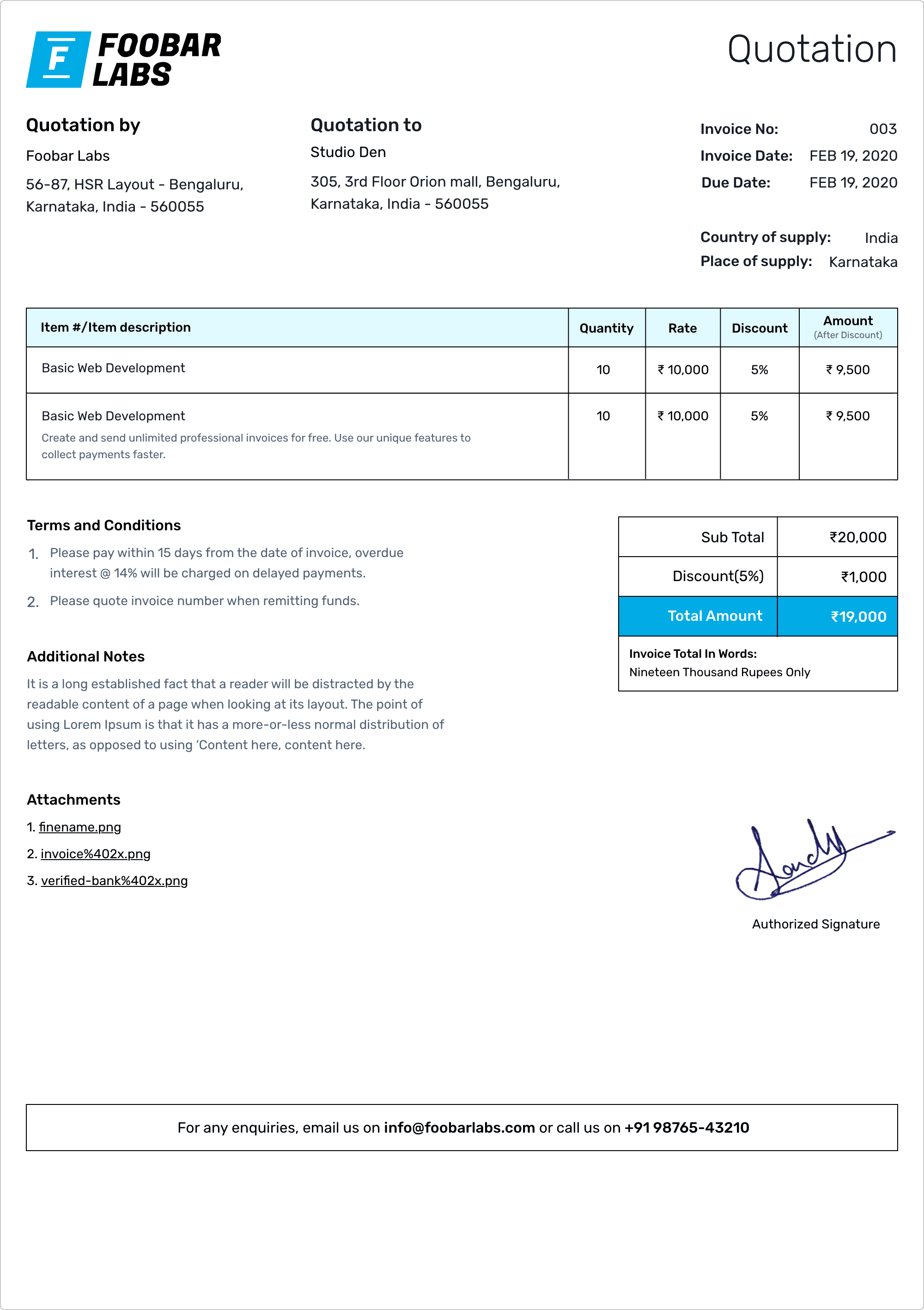

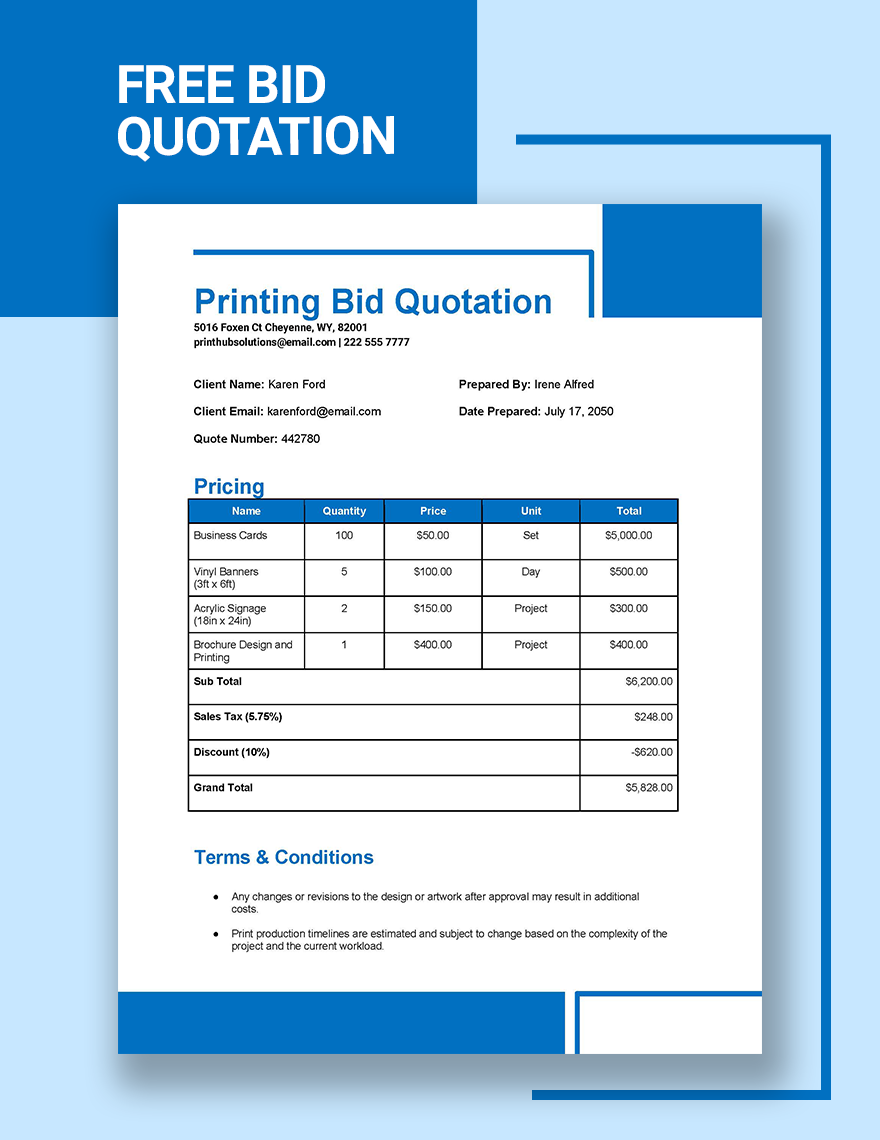

Understanding Your Travel Insurance Quotation

Once you receive a travel insurance quotation, it's essential to understand what it includes. Here's a breakdown of the key components:

- Premium: The total cost of the insurance policy.

- Coverage Limits: The maximum amount the insurance company will pay for each type of claim (e.g., medical expenses, trip cancellation, lost luggage).

- Deductible: The amount you must pay out-of-pocket before the insurance coverage kicks in.

- Exclusions: Specific situations or events that are not covered by the policy.

- Policy Period: The duration of coverage, typically aligned with your travel dates.

Common Mistakes to Avoid When Getting a Travel Insurance Quotation

- Failing to declare pre-existing conditions: This can invalidate your policy and leave you responsible for medical expenses.

- Underestimating coverage needs: Choosing insufficient coverage limits can leave you financially vulnerable in the event of a serious emergency. Based on my experience, it's always better to err on the side of caution.

- Ignoring exclusions: Be aware of what's not covered by the policy to avoid surprises later on.

- Only focusing on price: While price is important, don't sacrifice essential coverage for a cheaper premium.

- Waiting until the last minute: Purchasing travel insurance close to your departure date may limit your options and increase your premium.

Tips for Saving Money on Travel Insurance

- Shop around and compare quotes: Don't settle for the first quote you receive. Compare policies from multiple providers to find the best deal.

- Increase your deductible: A higher deductible will lower your premium, but make sure you can afford to pay it if you need to file a claim.

- Consider an annual travel insurance policy: If you travel frequently, an annual policy may be more cost-effective than purchasing individual policies for each trip.

- Look for discounts: Some insurance providers offer discounts for students, seniors, or members of certain organizations.

- Bundle your insurance: Purchasing travel insurance alongside other types of insurance (e.g., car insurance, home insurance) may qualify you for a discount.

Making a Claim

In the unfortunate event that you need to make a claim, follow these steps:

- Contact your insurance provider: Notify them as soon as possible about the incident.

- Gather documentation: Collect all relevant documents, such as medical records, receipts, police reports, and travel itineraries.

- Fill out a claim form: Complete the claim form accurately and provide all required information.

- Submit your claim: Send the claim form and supporting documentation to your insurance provider.

- Follow up: Keep in touch with your insurance provider to track the progress of your claim.

Conclusion

Obtaining a travel insurance quotation is a crucial step in planning a safe and worry-free trip. By understanding the factors that influence your quote, knowing where to get a quote, and carefully reviewing the policy details, you can find the best coverage at the right price. Remember to avoid common mistakes and take advantage of money-saving tips to maximize your protection without breaking the bank. Travel insurance offers peace of mind, knowing that you're protected from unexpected events that could disrupt your journey. It's an investment in your well-being and financial security, allowing you to explore the world with confidence.

Internal Links:

- [Link to another relevant article on your blog about travel planning tips]

- [Link to another relevant article on your blog about budgeting for travel]

External Link:

- [Link to a trusted travel insurance comparison website, such as Squaremouth or InsureMyTrip]

By following this guide, you'll be well-equipped to navigate the world of travel insurance quotations and make informed decisions that protect you and your travel investment. Happy travels!